People keep searching for tax saving tools. But did you know there is an effective tax-saving mechanism right in your home? Yes, and that is a Hindu Undivided Family (HUF).

An HUF consists of the Karta as the Head of family and all family members as coparceners. Broadly, an HUF consists of a common ancestor and all of his lineal descendants, including their wives and unmarried daughters. Buddhists, Jains, and Sikhs can also form an HUF. An HUF is automatically formed when marriage takes place but, for the purpose of an HUF to be a separate income tax assesse, there needs to be minimum of two coparceners. That means if an HUF consists of husband and wife, it will not become a separate assessee under income tax laws. Once a child is born, there will be a Karta and two coparceners, i.e. wife and child. Hence, this HUF will now become a tax-saving tool for the family.

An HUF must be formally registered in its name. It should have a legal deed. The deed shall contain details of the HUF members and the business / source of income of the HUF. A PAN number and a bank account should be opened in the name of the HUF.

An HUF usually has assets which come as a gift, a Will, or ancestral property, or property acquired from the sale of joint family property or property contributed to the common pool by members of an HUF.

Taxation

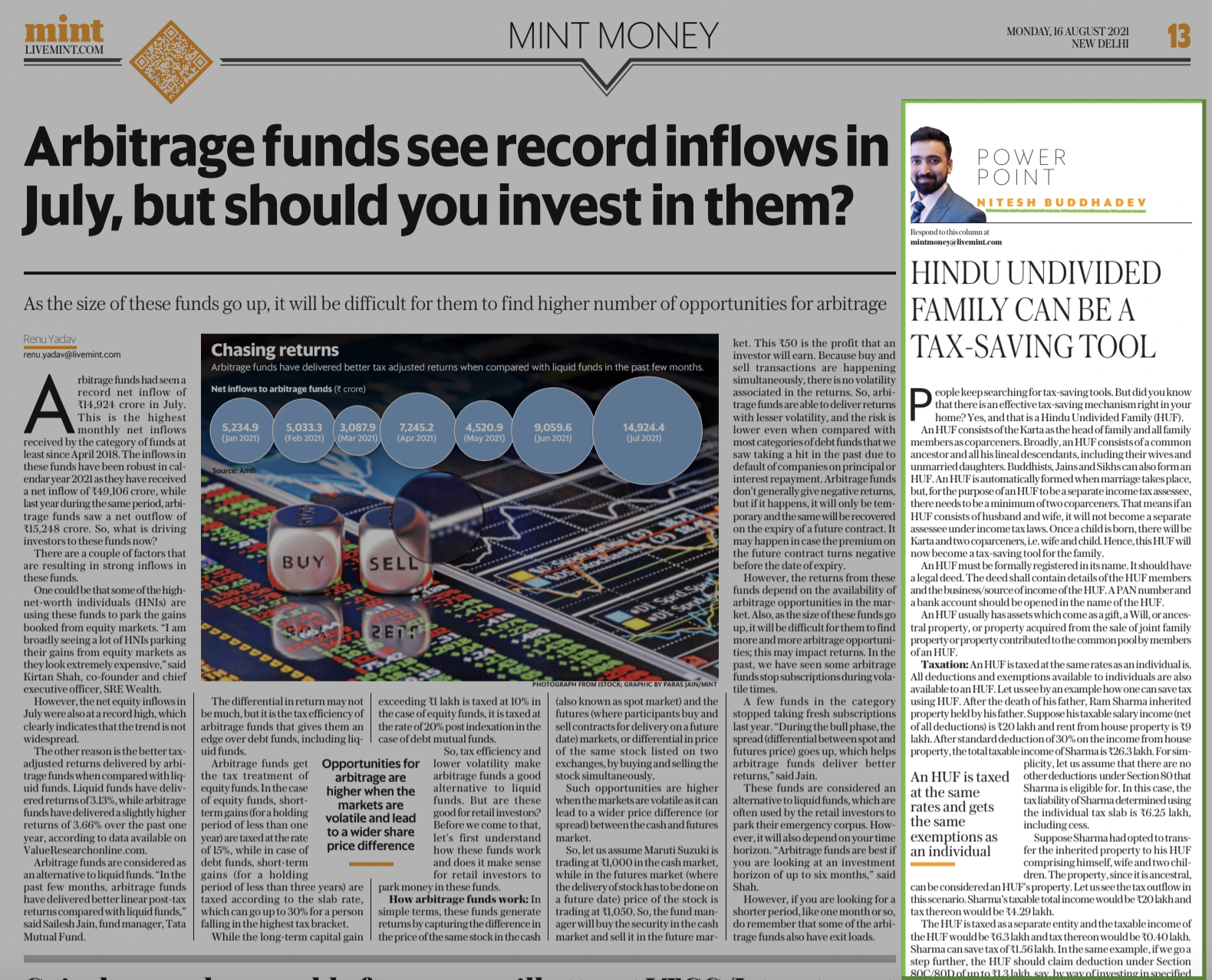

An HUF is taxed at the same rates as an individual is. All deductions and exemptions available to individual are also available to an HUF. Let us see by an example how one can save tax using HUF. After the death of his father, Mr Ram Sharma inherited property held by his father. Suppose, his taxable salary income (net of all deductions) is Rs. 20 lakh and rent from house property is Rs. 9 lakh. After standard deduction of 30% on the income from house property, the total taxable income of Mr Sharma is Rs. 26.30 lakh. For simplicity, let us assume that there are no other deductions under Section that Mr. Sharma is eligible for. In this case, the tax liability of Mr. Sharma determined using the individual tax slab is Rs. 6.25 lakh including cess.

Suppose Sharma had opted to transfer the inherited property to his HUF comprising of himself, wife and two children. The property, since it is ancestral, can be considered an HUF’s property. Let us see the tax outflow in this scenario. Sharma’s taxable total income would be Rs. 20 lakh and tax thereon would be Rs. 4.29 lakh.

The HUF is taxed as a separate entity and the taxable income of the HUF would be Rs. 6.30 lakh and tax thereon would be Rs. 0.40 lakh. Sharma can save tax of Rs. 1.56 lakh. In the same example, if we go a step further, the HUF should claim deduction under Section 80C / 80D of upto Rs. 1.3 lakh say by way of investing in specified mutual funds, payment of life insurance premium of coparceners, etc. Hence the net taxable income of the HUF will be Rs. 5 lakhs and no tax liability on this income will arise. Thus, by smart planning, Sharma can save tax of Rs. 1.86 lakh.

It is pertinent to note that, income from the transfer of a self-acquired asset, without adequate consideration or conversion of the same into joint family property, shall not be treated as the income of the HUF. For instance, Yash purchased house property for Rs. 1.5 crore and earns rental income of Rs. 4 lakh per annum on the same. Every year Yash invests the Rs. 4 lakh of rental income in bank fixed deposit and earns interest of Rs. 28,000. His Salary Income is Rs. 20 lakh. Can Yash transfer the house to his HUF (without any consideration) and save tax?

If the self-acquired property of an individual is converted into joint family property without adequate consideration, the income derived by the joint family on account of such property shall be included in the total income of the individual who owned the property. Hence, even if Yash transfers the house to the HUF, the rental income will be charged to tax as Yash’s income and he will not be able to save tax. But the interest earned of Rs. 28,000 will be taxed as income of the HUF and not clubbed as Yash’s income. Hence, he will be able to save a miniscule amount of tax on the interest portion.